"Shawston is growing quickly because decisions are getting made by the people, not just by the directors. This is what EO culture is all about. It works, so says our share price growth. So says all the evidence that is available for you all to see." - Rob Davenport, CEO

“I REALLY LIKED THE THOUGHT OF HAVING A STAKE IN THE BUSINESS – I THINK IT MAKES IT MORE YOURS AND YOUR BECOME MORE DEDICATED TO ITS SUCCESS”

Share Price

Employees

Ownership

Becoming a Co-owner

Employee Ownership (EO) means employees own a stake in the company. You can buy shares at a discounted rate on the annual Dealing Day, and you have the option of either paying for the shares directly or by taking out a company loan.

Monetary Gain

All shareholding employees will benefit from share price increases and dividend payments when the business performs well. Shawston has a great history of paying dividends and increasing share price, this is mainly due to the hard work and ‘ownership’ mentality of its employee co-owners.

Culture

EO is about empowerment and confidence, each shareholder begins to think, feel, and act like business co-owners. This culture is what sets EO businesses apart from everyone else, it is the reason we are more likely to survive a recession, to outperform our competitors and to see higher levels of employee engagement and retention. Basically, 130 minds are better than 1!

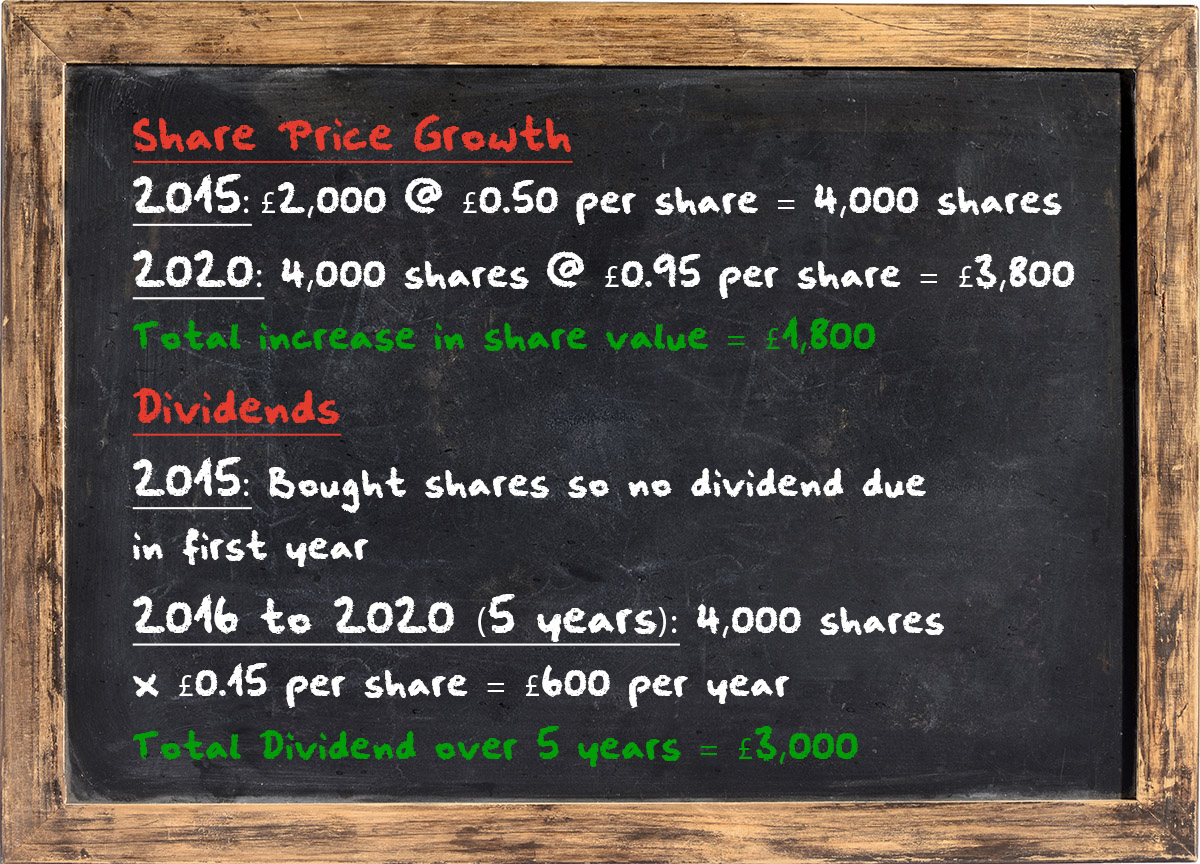

A general example of the financial benefits of share ownership

Share Price Growth

Eric joined an employee-owned business in 2015 and bought £2,000 of shares from his own money. He paid £0.50p per share meaning that he now owns 4,000 shares.

Since 2015, the share price has increased every year and in 2020 the share price is £0.95, which is a 90% growth. His shares are now worth £3,800 which means they have increased in value by £1,800.

Dividends

When the business hits its annual financial targets, it can pay a dividend out of its ‘retained profit’. A dividend is an amount of money for every share you own.

Since Eric joined the business, a dividend of 15 pence per share has been paid every year. This means he has received a dividend payment of £600 every year since buying his shares.